It’s tax season once again in Italy, and I am getting ready for those F24s to land in my inbox and tell me how much I owe. Everybody loves to complain about taxes in Italy, but there’s something to say about the services they provide as well. It’s not like in the US where the money we fork over goes to the military etc. A lot of our taxes go to social services, healthcare, and things that the state provides. But I did find myself wondering, where exactly does our taxes in Italy go? How is it divided? (and more importantly, where can I complain “my tax dollars go to this?!?”)

Well, I did what I do best, reading through bureaucratic websites and awkwardly written articles to find out what I could. Here’s what I got:

What are the taxes in Italy we have to pay?

First off, let’s just address what we have to pay. There are many if you break it down, but to keep today’s conversation simple and give you a straight answer, let’s only talk about the ones we all pay: IRPEF and IVA. IVA is paid by everyone even when you don’t have a job in Italy, these are the taxes we pay when we purchase items.

IRPEF is the tax individuals pay when you have an income (forfettario’s not included). For most this is tax rate in Italy is broken down into three tiers:

- il 23% on income that is up to 28.000 euro;

- il 35% on income that is up to 50.000 euro;

- il 43% on income that is above 50.000 euro.

However, as you may already be aware if you fall under the Partita IVA “regime forfettario” then we don’t pay IRPEF, but something called l’imposta sostitutiva which is 5% for the first 5 years, then 15%.

Then we also have a bit of fine print…. Those numbers we just talked about refer to what we may call an “income tax”. However, there are still the “contributions” which refer to the taxes paid to INPS (that would be who is in charge of our pensions, maternity, disability, etc).

If you are a forfettario, with gestione separata then it’s simply around 26% (the exact number changes yearly but it sticks to about 26%. For others… well, consult with your commercialista or CAF.)

If you are employed it is a bit more complicated, but the good news is it’s already handled in your pay check so you don’t need to worry. In this case as far as pensions go:

- 23,81% tax is paid by your employer

- 9,19% is paid by you

Then it gets even more mathematical. Contributions to fund welfare insurance (like sickness, maternity, etc.), as well as other social security insurances, are sometimes calculated differently depending on the industry the company belongs to. But here’s a peek at that in case you want to really nerd out about where every cent is going (taken from the INPS website):

- Unemployment contribution (for T.D. reports. +1.40%): 1.61%;

- Economic sickness allowance (variable measure depending on the sector): 2.22% – 3.21%;

- maternity contribution (variable measure depending on the sector): 0.24% – 0.46%;

- Assegno Unico: 2.48% (0.68% reduced);

- Fondo di garanzia TFR (severance pay guarantee): 0.20%;

- Cassa Integrazione Guadagni Ordinaria (short company suspensions): 1.70% – 4.70%;

- Cassa Integrazione Guadagni Straordinaria (crisis and restructuring): 0.90%;

- Fondi di solidarietà or Fondo di Integrazione Salariale: 0.45% – 0.65%.

Now those are the most “essential” taxes we all pay, but there are also ones for the car, for the trash collection, property taxes, municipality tax, etc etc. But these are all very dependent on where you are living, what your living situation is etc. So for today, we’re not going to worry about them.

Where do all our taxes go in Italy?

Now we know what we pay, where does all that money go?

Well for all those “other taxes” like TARI, municipality, canone RAI, those taxes are going directly to the service they pay for, simple enough.

Instead the money we pay in other taxes like IRPEF, IMU (housing), and IVA, are the ones we are curious about, and the Agenzie delle Entrate is ready to answer.

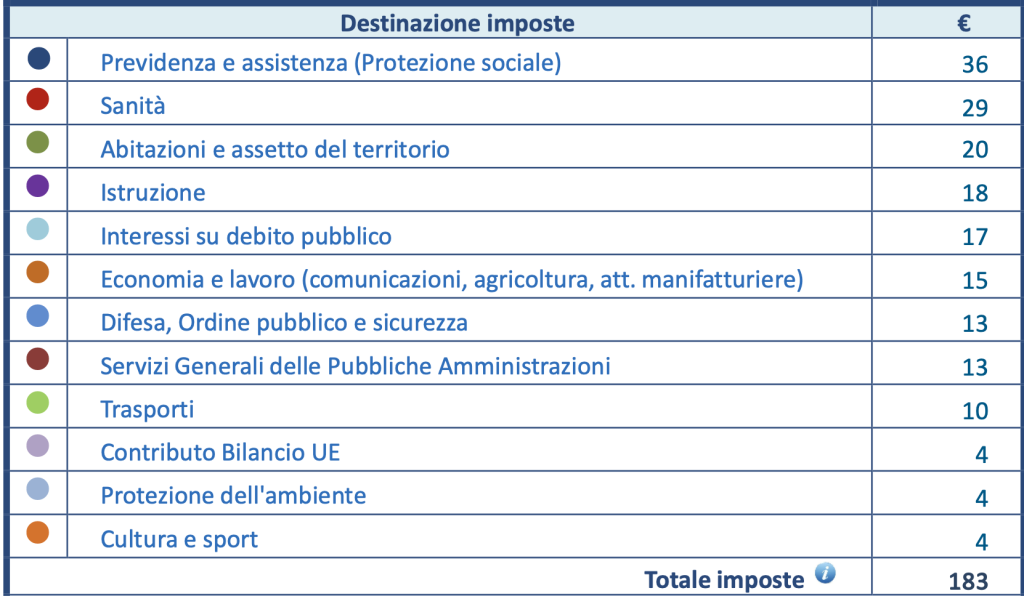

In honor of transparency, they actually publish a large table in your personal account showing you exactly where your money went. It’s quite cool to find and look if you really want to know.

But for those of you who don’t want to bother dealing with that website, well let me give you the generic averages.

Out of the entire budget the State received via taxes in Italy, about 21% goes to paying for services covering “previdenza e assistenza”. Basically, this is a general look at social services. This could include other pensions, or welfare for those in difficulty. Some additional money goes to similar services through INPS. However, I honestly could not get to the bottom of how they differ on this point. I believe INPS is personal to you specifically, and this Previdenza e assistenza goes to more general services for all.

Moving on, 19% goes to healthcare and about 11% is to settle the public debt. 10.8 % goes to education and culture and sport are lumped together and only receive 2.3% (equal to 262 million).

Now these numbers actually change every year, so it’s just to give you a general idea. But if you want to keep up to date with exactly where your money is going, they do share where your exact imposte taxes went, euro for euro.

Seeing Where Your Personal Taxes Go

If you want to take a look at where your euros are going, the Agenzie delle Entrate has created full transparency. Head to their website and log in with your SPID, then go to your “cassetto fiscale” click on “consultazioni” and then “dichiarazioni delle imposte” and you’ll be able to download your own personal report. Which looks a little like this:

Wrapping It Up

I’m aware that might not be all the information you are looking for, but it certainly made me a little happier to understand generally where my taxes in Italy are going. Be sure to check out your own account and remember that it does change year to year. As you can see, our taxes are going to some useful services, even if they are at times, a bit high for us.

If you found this information helpful you can show your support by buying me a glass of wine 🥂. I really appreciate it and each glass inspires me to research more into life in Italy!

And if you are looking for more help on your journey of making Italy home or looking for local insight to plan the best trip, get in touch, let me help you experience authentic Italy.